Green leases and ESG: How Australian real estate shapes up against other major countries

The journey of ESG in Australia

ESG in Australia has come a long way over the last decade. A mix of occupier demand, investor commitments and government requirements has led to this once outer topic becoming part of Australian real estate’s DNA. Green leases are now the default for most leases in major office markets.

But how do we compare to other global markets like the UK, France, Germany, and the USA in adopting and shaping green leases? Let’s break it down.

Australia: Market-led, ratings-driven

Australia’s commercial real estate sector shines globally in market-led green lease adoption. With our world-leading frameworks like NABERS and Green Star, major players like Dexus and Charter Hall include green clauses as standard across most leases requiring aspects like:

- Mandatory energy data sharing

- Access for sustainability upgrades

- Joint action plans on energy/water use

While not legally required, Australia’s Commercial Building Disclosure (CBD) program supports transparency and market discipline too.

Australian office stock is newer and larger than that in other markets like the UK or France. As a result, comparatively more Australian offices are certified as the highest sustainability grades.

UK: Powered by regulation & the market

The UK has arguably the most robust green lease legislation of the countries considered here. This is due to the Minimum Energy Efficiency Standards (MEES). It mandates that from 2030, commercial leases will only be allowed in buildings rated EPC B or above, a massive driver of green lease adoption. UK green leases typically include:

- Operational collaboration clauses

- Emissions tracking and data sharing

- Energy improvement obligations

Market participants have prioritised green leases for some time in response to occupier net-zero demands and investor sustainability commitments. Green leases are standard practice in most large office markets.

France: Government-led growth

In France, green leasing is largely driven by the ÉLAN law, which mandates environmental clauses for larger leases. The Décret Tertiaire, another piece of legislation, further pushes building emissions targets to 2030 and beyond.

French green lease clauses focus on:

- Energy data exchange

- Fit out waste reduction

- Shared sustainability targets

Pioneers like Gecina, an investment manager, are evolving these clauses into performance-based charters with occupier accountability. However, French investors are less motivated than those in other markets by green leases.

Germany: Emerging but fragmented

Green leases in Germany are progressing more slowly. While the Building Energy Act (GEG) supports disclosure and efficiency, green lease clauses have not yet become mainstream. Where used, they typically include:

- Basic disclosure requirements

- Clauses for retrofit cost-sharing

- Reference to ESG reporting standards

Adoption is rising in institutional portfolios, but broader market uptake remains limited. Occupiers are resistant to the perceived higher cost burden, with German investors also appearing to be less motivated compared to other markets.

USA: A tale of two (or more) markets

The US green lease landscape is highly regional. In states like California and New York, city-level mandates like Local Law 97 have accelerated adoption but elsewhere, no such legal support exists. In leading cities, green lease clauses include:

- Utility benchmarking

- Landlord rights to upgrade systems

- Sustainability targets in lease riders

Programs like Green Lease Leaders, which seeks to recognise organisations which promote green leases, are gaining traction but much of the country remains early-stage. However, there are significant environmental and financial gains for occupiers to do so quickly. Estimates suggest that US$3.3 billion could be saved if every US building implemented green leases1.

Final Takeaway: The green lease as a strategic tool

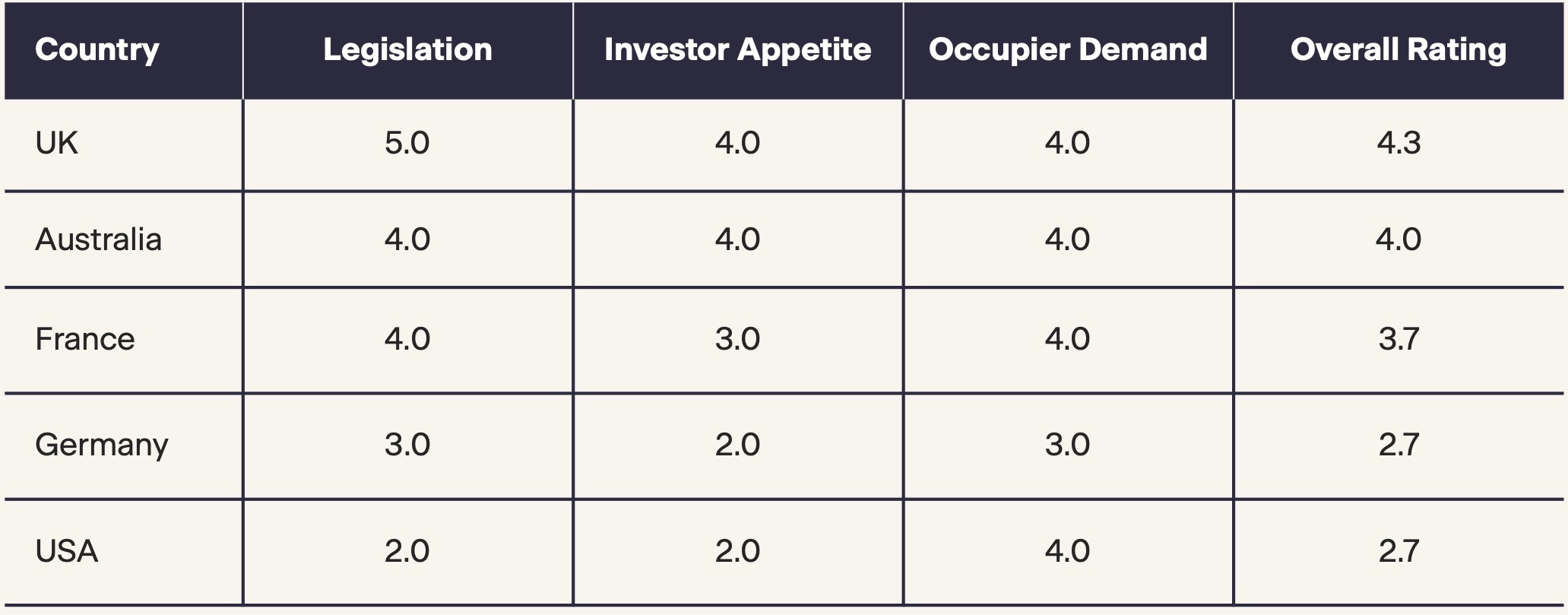

Green lease uptake varies across the major markets considered here, with the UK most advanced in our view followed by Australia (Table 1). The USA and Germany are laggards.

Table 1: Green lease penetration & drivers

In Australia, green leases emphasis is on collaboration and transparency. In the UK and France, regulation drives adoption but occupiers and markets support it too. In the US and Germany, ESG innovation is patchy but growing.

However, all markets are slowly converging. Occupiers now demand real estate that supports their net-zero ambitions. Scope 3 reporting with green leases is an easy tool to ensure that. Investors are increasingly encouraging occupiers to accept green leases to meet their own sustainability objectives. With legislation only becoming stronger, the prevalence of green leases will only become more common and their inclusions more standardised between different countries.

Reference

1 JLL. (2025). “Integrate sustainability into lease agreements strategically”. Accessible from: Green Leasing Services | JLL

Related posts

Dive deeper into insights that matter to you.

Australia’s Love of Big Homes Was Rational, Until the World Changed

The next flex office wave

Retail on the Rise: Australia’s shopping centre revival

State of the States: A comparison of demographic trends

Make smarter decisions

Get in touch with the Team to get an understanding of how we transform data into insightful decisions. Learn more about how Atlas Economics can help you make the right decisions and create impact using our expertise.